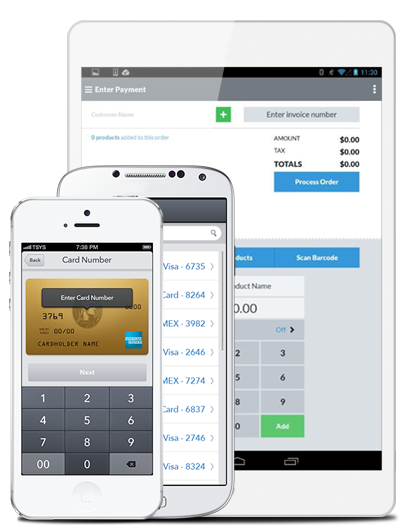

Mobile Payment�

Acceptance

�

Turn supported mobile devices into fast, reliable and secure mobile payment terminals that allow customers to sign for transactions right on the screen.

� � �

�

�

�